Latin America Power BV shareholders sued SunEdison Inc., claiming the world’s biggest clean-energy developer is on the brink of bankruptcy and trying to hide assets.

The shareholders say they need a court order to protect SunEdison assets while they pursue a claim in arbitration for $150 million, which they say they’re entitled to after the U.S. company walked away in October from an agreement to buy Latin America Power.

SunEdison has “defiantly declared” that it plans to hide its assets with undisclosed parties and affiliates in order to shield them from creditors as it sits on the brink of bankruptcy, the investors said in a petition filed in state court in Manhattan. SunEdison’s financial condition “is so dire and rapidly worsening” that analysts expect it to be insolvent by the time the arbitration might be decided, the shareholders said.

Ben Harborne, a SunEdison spokesman, said in an e-mail that the company would fight the lawsuit.

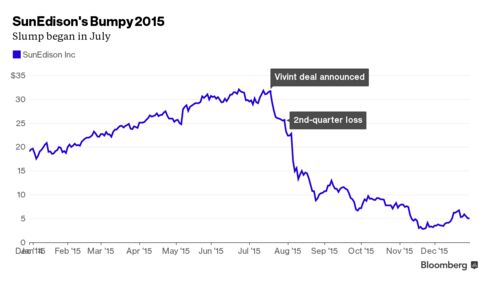

SunEdison shares have plunged 88 percent in the past year.

SunEdison agreed to buy Latin America Power in May, amid a buying binge across the Americas. At the time of the announcement, the Santiago-based Latin America Power had 119 megawatts of hydroelectric and wind-energy plants operating in Peru and Chile, and was building 214 megawatts of wind and hydroelectric projects in Chile.

At the time of the cancellation, SunEdison said that the sellers failed to satisfy certain conditions. “Instead of remedying these issues, the agreement was terminated,” a spokesman for Maryland Heights, Missouri-based SunEdison said in an e-mailed statement in October. “While SunEdison is disappointed by this outcome, we remain committed to pursuing attractive opportunities in Latin America.”

BTG Pactual partnered with investment fund P2 Brasil and Brazilian GMR Energia to acquire Latin America Power in 2012.

In December, SunEdison canceled another deal involving a Latin American developer, Renova Energia SA. It had planned to buy a 16 percent stake in the company. Renova began restructuring its operations late last year after the deal was scrapped. Earlier this month, Bloomberg reported that Renova is considering cutting half its staff this year to help reduce costs.

In January, SunEdison was sued by billionaire David Tepper’s Appaloosa Management LP over the renewable-energy developer’s planned $1.9 billion acquisition of Vivint Solar LP. SunEdison had planned to flip Vivint’s assets to TerraForm Power Inc., a company it formed and controls. Appaloosa, which owns a 9.5 percent stake in TerraForm, said the deal was “fundamentally unfair” to TerraForm’s investors.

The case is BTG Pactual Brazil Infrastructure Fund II v. SunEdison Inc., 650676/2016, New York State Supreme Court, New York County (Manhattan.)

SunEdison Sued by Spurned Latin America Power Shareholders – Bloomberg